Operating a small company can be a challenging job, and having actually the right accounting software can make it a lot easier. Small entrepreneur know the importance of choosing the right accounting software for their procedures. That is why we’ve put together a listing of the best accounting software for small companies in 2023, to assist you start. Let’s dive in!

What is Accounting Software?

Accounting software is an effective device that streamlines the monetary management process for companies of all dimensions. It streamlines accounting jobs such as invoicing, payment tape-taping, expense monitoring, record generation, and account bookkeeping by automating them.

Accounting software also features integration with business checking account, automated expense classification, and deal monitoring, so companies can easily manage their financial resources with real-time monetary information and integrated error-checking features.

This helps to decrease mistakes while conserving time on routine jobs such as reconciling financial institution declarations and producing monetary records and billings. Consequently, entrepreneur can focus more on what’s truly important, such as sales and customer support, maximizing time for various other necessary tasks.

Benefits of Accounting Software for Small Business

Accounting software is essential for small companies, as it helps improve monetary procedures and decrease the quantity of time invested in management jobs.

Here are 6 key benefits of having actually accounting software in your small company:

- Automates Monetary Processes – Accounting software automates processes such as invoicing, invoicing, and resettlements, production them much faster and easier to handle.

- Improves Effectiveness – By automating and arranging monetary procedures, accounting software helps improve the overall effectiveness of a company.

- Reduces Human Mistake – With its automated processes, accounting software significantly decreases the chances of human mistakes within a company.

- Generates Records Quickly – Among the essential functions of accounting software is producing records such as earnings declarations and annual report more accurately and quickly.

- Enhances Decision-Making – By providing easy access to monetary information, accounting software helps small companies make better choices that can improve their profits.

- Provides Security – With features such as secure login qualifications and multi-level verification, accounting devices provide improved security for managing monetary information.

Best Accounting Software: Our Top Picks in 2023

Are you looking for the very best accounting software to optimize your small company procedures in 2023? We’ve done the research and limited the list of top accounting software options.

1. QuickBooks Online

QuickBooks Online is a prominent accounting software because of its effective features, scalability, and capacity to provide to small companies with elaborate monetary requirements. It has a large user base worldwide, production it most likely that the accountant recognizes with it. The software’s all-in-one control panel enables efficient bookkeeping.

There are also lots of online sources and forums available for support. Taking a QuickBooks course is a great way to find out about the top accounting software.

Pros:

- Scalable for companies of various dimensions and development stages

- Widely used by accounting experts, which ensures compatibility and support

- Integration with third-party applications, providing more versatility and personalization options

- Cloud-based and has a mobile application, enabling easy access and management from anywhere

- Offers extensive record-keeping, invoicing, stock management, and coverage features

- Provides excellent client support, consisting of everyday telephone support and 24/7 chat support in all plans

Disadvantages:

- An update is required for more users, which can increase costs significantly

- Occasional syncing problems with financial institutions and charge card lead to potential information inconsistencies and mistakes

- A learning contour, which may require additional time and sources to fully grasp the software

- Expensive compared with the competitors, particularly when considering additional costs for payroll features and limited account users with each plan.

2. FreshBooks

FreshBooks is a great option for small service-based companies and freelancers that focus on mobile application adjustable invoicing and use. It offers basic bookkeeping features such as expense monitoring, project time monitoring, and management.

FreshBooks is easy to use and affordable, with plans beginning at $15 monthly for up to 5 customers. It is designed for those without an accounting history and is a great in shape for service-based companies such as specialists, internet professional digital photographers, and developers.

Pros:

- Cloud-based accounting software can be accessed from anywhere with a web link.

- User-friendly user interface that’s easy to browse and requires little accounting experience.

- Integration with third-party applications that connect to various business software, providing more improving process and versatility.

- Affordable pricing plans that are affordable for small companies or freelancers.

- Advanced invoicing features that permit for adjustable and professional-looking billings with automated payment pointers, and repeating invoicing options.

- Mobile application with standout functionality and features, enabling managing your business on the move, consisting of sending out billings, tape-taping more, and costs.

Disadvantages:

- Mobile application performances are limited.

- The software does not have some features that can be essential for fast-growing companies, such as the ability to review investigate trails.

- Lower-tier plans have a top on the variety of billable customers.

- Payroll isn’t consisted of in any one of the plans and is just available as an extra feature.

3. Xero

Xero is a prominent accounting software with a adjustable control panel that takes on QuickBooks Online.

It allows limitless users and integrates with a third-party payroll solution. The Very early plan starts at $13 monthly and consists of basic features such as financial institution business pictures and reconciliation.

For $37 monthly, the Expanding plan offers mass deal reconciliation and limitless expense going into and invoicing. The Established plan, for $70 monthly, includes project monitoring, expense declaring, several analytics, and moneys.

Pros:

- Cloud-based and comes with a user-friendly mobile application

- Payroll integration with Gusto makes payroll processing a wind

- Large choice of third-party applications available through its marketplace

- Simple stock management to monitor your stock degrees

- Unlimited users in all pricing plans to permit more staff member to access and work on your account

- 24/7 support, together with an user friendly user interface and a variety of plans to update as your business expands.

Disadvantages:

- Limited coverage abilities

- Fees billed for ACH resettlements

- Limited customer support options, with no telecontact number available for support

- The entry-level plan has limits on expenses and billings (5 and 20 monthly, respectively), and several moneys are just available with the highest-tiered plan.

4. Sage Business Shadow Accounting

Sage Business Shadow Accounting offers 2 affordable plans for small companies with up to 10 workers, consisting of investigate trails and third-party integrations.

The $25 monthly plan comes with limitless users plus capital projecting. The Sage Accounting Begin plan is simply $10 monthly and has automated financial institution reconciliation, billing development, and monitoring of what you are owed, plus features and integrations – great for micro-businesses and start-ups requiring affordable accounting software.

Pros:

- Provides a solid stock management system, basic invoicing, and a user-friendly mobile application.

- Offers affordable pricing plans compared with its rivals.

- Provides weekday telephone support for all plans.

- A cloud-based system that enables easy access to information from anywhere.

- Offers a wide variety of integrations to support various business needs.

- Supports automated financial institution several moneys and reconciliation.

Disadvantages:

- Limited third-party integrations and records when compared with some rivals.

- Inability to manage purchase billings or send out estimates and estimates with the entry-level plan.

- The software’s basic features may not suffice for established companies.

- Payroll management isn’t consisted of, which may be troublesome for some companies.

5. Wave Accounting

Wave is free software that is great for service-based small companies that do not need payroll, offering limitless collaborators and financial institution/credit card links with no hidden upgrades or costs.

It has all the essential features needed and at year-end accounting professionals can easily draw records to assist prepare your business’s tax obligation return.

The perfect service for basic accounting jobs, without the hassle.

Pros:

- Wave offers free accounting software that consists of invoicing and invoice scanning features.

- Unlike some various other software, Wave does not limit deals or invoicing.

- With Wave, users can manage several companies in one account, production it a great option for business owners with several endeavors.

- The software also supports a limitless variety of users, production it a scalable service for expanding groups.

- Wave’s mobile application provides easy access to monetary information on the move.

- Wave’s adjustable invoicing abilities are user-friendly and can rival those of more expensive accounting solutions

Disadvantages:

- Lacks advanced features such as investigate trails, which may not fit quickly expanding companies.

- Higher fees for credit card and ACH resettlements compared with some rivals.

- Full-service payroll is just available in 14 specifies.

- Limited integrations just through Zapier.

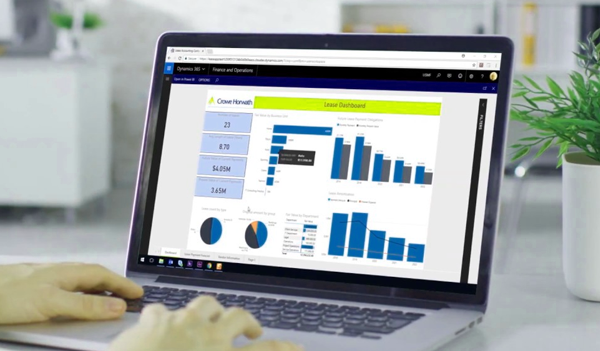

Practical uses of BI in accounting firms

Utilizing business intelligence in accounting goes beyond serving local clients. Its significance grows exponentially as you expand your services globally, particularly due to the increasing implementation of digital accounting requirements in different jurisdictions.

For instance, Australia is actively moving towards achieving the Digital Economy vision by 2030. Meanwhile, the U.K. has already adopted Making Tax Digital (MTD), a government initiative mandating businesses to digitally record and declare their taxes to the HMRC (HM Revenue and Customs).

By leveraging business intelligence and reporting tools, accountants can:

- Uncover valuable insights from financial data.

- Access data for performance and competitor analysis.

- Deliver easily understandable reports and visualizations to clients.

- Evaluate processes to enhance efficiency and risk management.

- Analyze market trends to inform decision-making.

- Conduct comprehensive cash flow analysis and forecasting, utilizing historical, current, and predictive perspectives of business operations generated through BI software.

Overall, the real-time information provided by BI tools empowers accountants to deliver enhanced value to their respective clients.

Benefits of business intelligence to accounting firms

By enhancing your business intelligence (BI) capabilities, your accounting firm can achieve numerous benefits:

- Increase productivity:

- Eliminate the need for manual data collection and processing, leading to higher productivity and reduced errors.

- Improve accounting processes:

- Gain better visibility into your accounting processes and metrics through BI’s dashboard and visualization tools.

- Access up-to-date information:

- BI tools provide timely access to critical information, such as market trends, global supply chain status, and talent shortages within your organization.

- Enhance client decision-making support:

- Utilizing business intelligence in accounting enables you to generate and communicate insights, empowering your clients to make better-informed decisions.

- Foster strategic advisory role:

- Empower your team by enhancing their knowledge and skills in BI and other data analytics tools, elevating their status as trusted strategic advisors.

- Leverage BI-powered cloud accounting software to automate manual tasks, allowing your team to focus on analytical tasks rather than tedious number crunching.

- Achieve higher audit ratings

- Business Intelligence (BI) reduces the need for extensive human intervention during data entry and processing, resulting in fewer errors in your clients’ books. As a result, your audit performance can significantly improve.

- Enhance your firm’s overall operations

- By leveraging BI, you can closely monitor your financials, optimize your supply chains, gain deeper insights into the labor market, benchmark your competitors, and make more informed business decisions. These capabilities contribute to enhancing your firm’s overall operations.

- Unlock new business opportunities

- Embracing a digital-centric approach positions your firm to attract clients seeking forward-thinking accounting partners, creating new opportunities for collaboration and growth.

- Stay competitive in the market

- Strengthening your technological capabilities ensures that you remain relevant in an evolving marketplace. As the world progresses towards digitalization, being ahead of your competitors becomes increasingly vital.

- Retain your existing clients

- By offering BI-enabled services to your existing client base, you can implement an effective upselling strategy, particularly for those still reliant on manual accounting processes. Instead of seeking advisory services elsewhere, your clients can receive them directly from your accountants and CFOs.

In summary, embracing BI capabilities in your accounting firm brings about increased productivity, improved accounting processes, access to real-time information, enhanced client support, and a transformation into trusted strategic advisors.

Business intelligence and data analytics are currently the leading tools for delivering exceptional accounting solutions amidst the ongoing wave of digital transformations. These technologies shape the future of accounting.

If you are seeking back-office support to enhance your firm’s BI capabilities, D&V Philippines offers customizable, high-end support to accounting firms and other professional services organizations. We can assemble a team of globally competitive accountants who will work under your complete operational control.

Se Also: